How TMX works...

TMX began operations in 2018, with a goal to increase access to markets for buyers and sellers of commodities in Tanzania. Well, here is the Tanzania Mercantile Exchange, but how does it really work?

Undertanding the Exchange Ecosystem

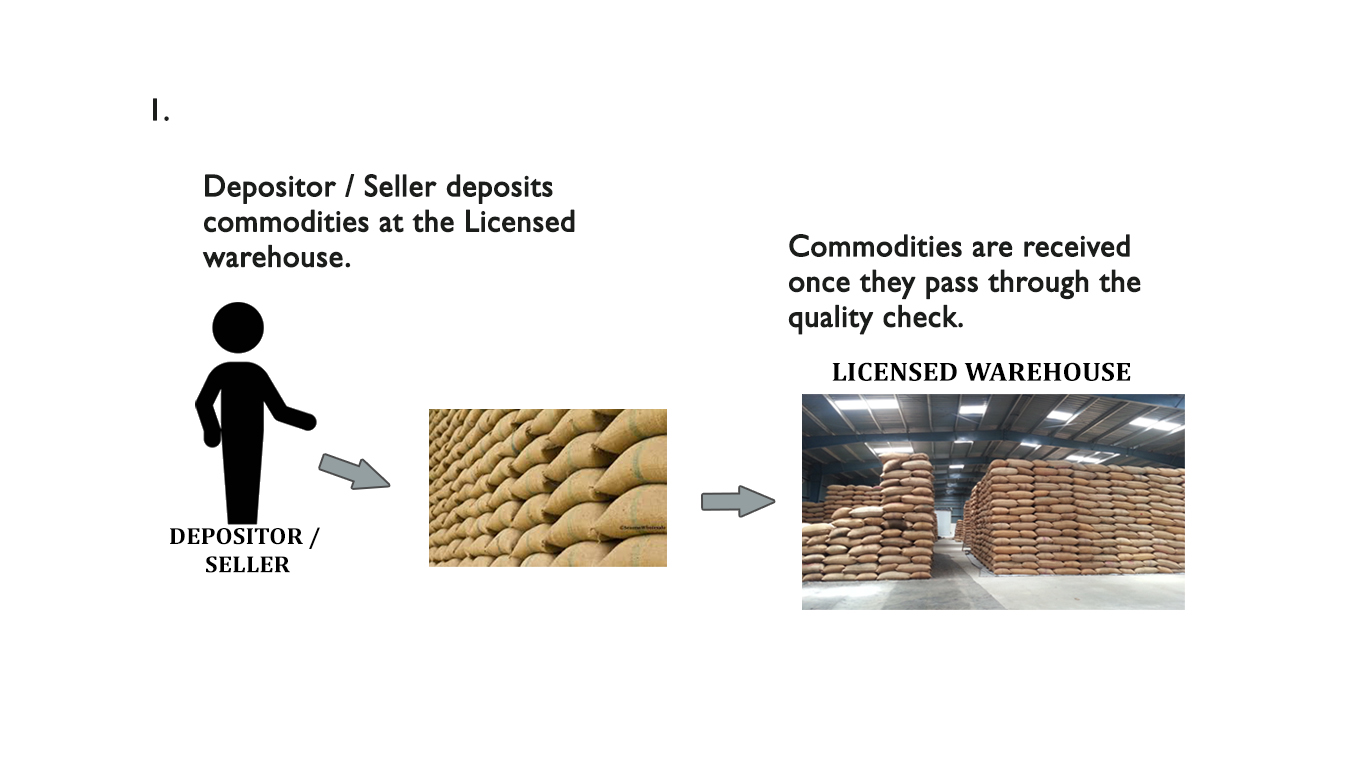

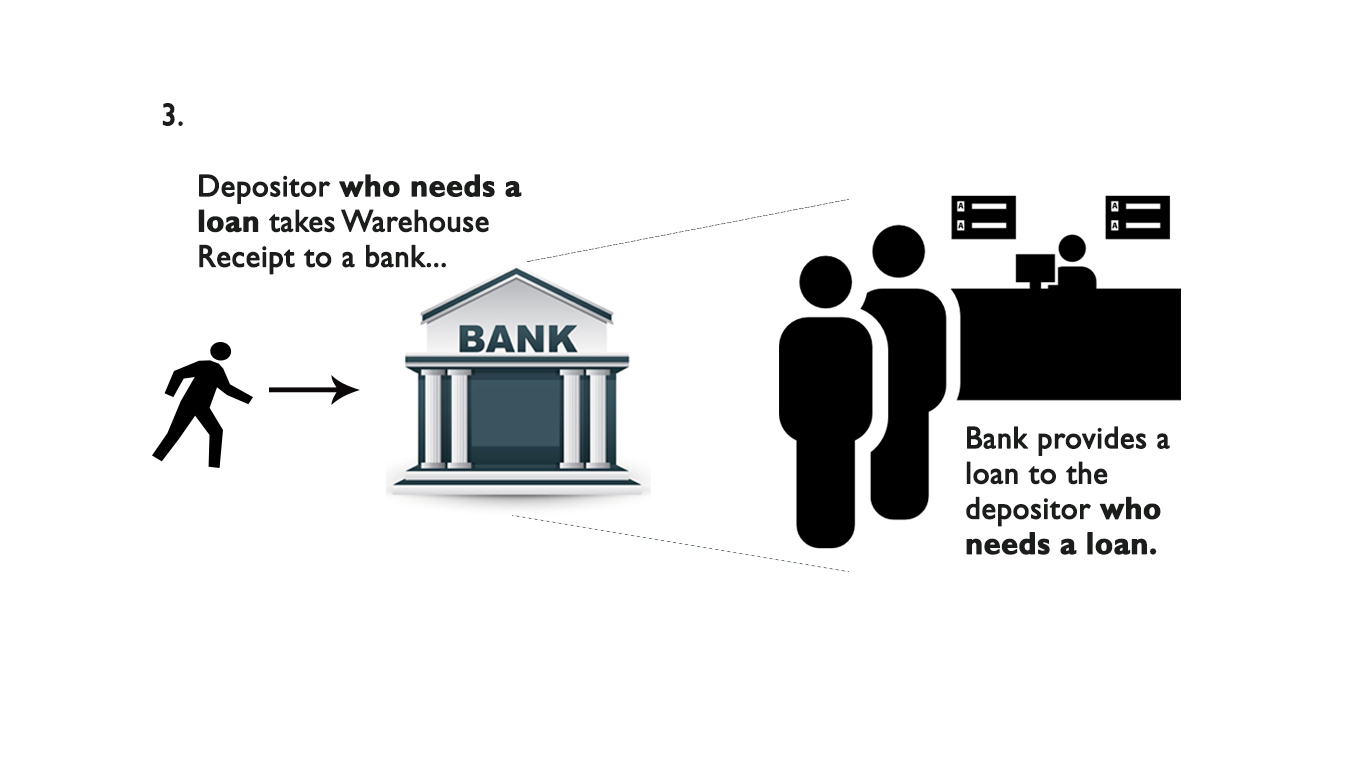

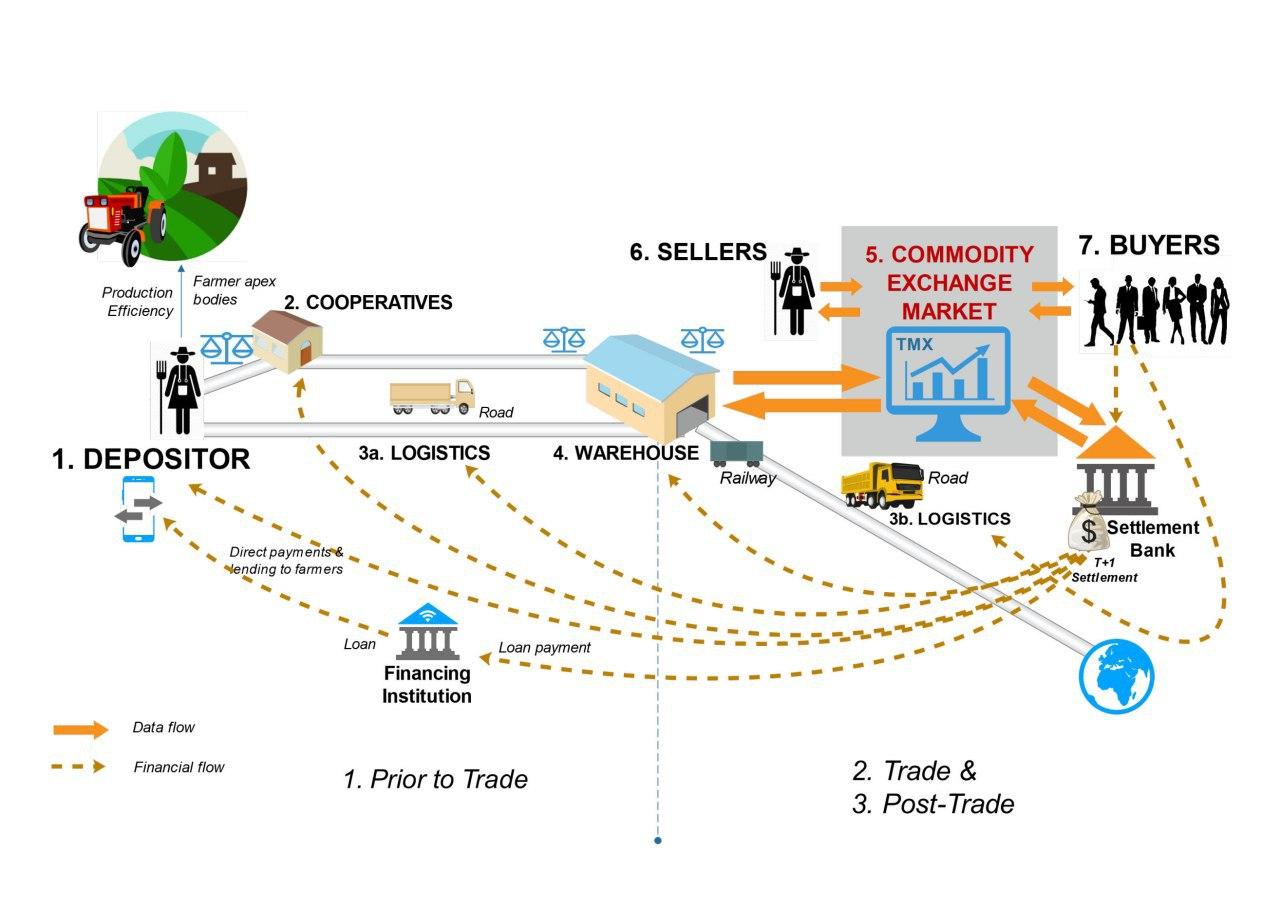

The Commodity Exchange ecosystem covers all a wide spectrum starting from the producer to the consumer of the commodity. The Exchange ecosystem starts from the harvest season, farmers aggregate their produce through the Agricultural Market Cooperative Societies (AMCOS). The AMCOS record the farmers and their produce at collection centers, store them temporarily and transport the commodity to the licensed warehouses. The licensed warehouses are supervised by the Warehouse Receipt Regulatory Board (WRRB). The depositor will then be registered and the commodity will be taken for quality tests. If it meets the standards set for the particular commodity, a Quality Certificate will be issued once accepted by the depositor, and commodity will be weighed and stored in the warehouse. The Warehouse Operator will issue a Warehouse Receipt to the depositor, and upload it in the Warehouse Receipt System (WRS). Once assured by WRRB, the WRS is linked to TMX Online Trading Platform where the information will then be used to prepare trade sessions. TMX will ensure trade sessions are held in the knowledge of market actors and all involved stakeholders. Once trade sessions are closed, TMX will carry out clearing and settlement operations, ensuring payments to sellers are done timely and buyers get ownership of the traded commodity assured of quality and quantity. The buyers can then proceed with delivery process at the respective warehouses.

More About TMX Operations

- Market manipulation practices- an act by a market participant or a group to deceive in prices or volume of a commodity.

- Insider trading – commodity trading made by TMX employee, Board member or affliate based on insider information.

- Misstatement – Rumors or false information to mislead the public in making a commodity trading decision.

- Tanzania Mercantile Exchange (TMX) shall employ the use of software models for generating real time price, volume, alerts for each trading member’s unusual trade activities.